By Kenneth Artz, The Heartland Institute

Beginning in 2014, ObamaCare will require employers with fifty or more full-time employees to offer affordable coverage to all of their employees or risk a hefty per-employee fine. As industries weigh the benefits of cost of coverage versus paying the fines, officials for trade groups representing nursing homes and other low-wage employers are considering asking the Department of Health and Human Services for a waiver excusing them from providing health insurance to their employees.

Medicaid and State Sovereignty

“Within the courts, the issue that has received the most attention is the individual mandate, the mandate that everyone has to purchase health insurance or pay a penalty. People see that as exceeding the commerce power, and that’s why it was struck down in the district court in Florida, by Judge Vinson … But there’s another issue that he issued summary judgment on, this time ruling against the states, and that was as challenge to the Medicaid expansion provisions.

Those provisions require that states expand their Medicaid programs as a condition of continuing to receive federal matching grants. On that count, Vinson ruled that there was no coercion, because he said there’s no level of economic penalty that the federal government could impose on the states that would be so onerous as to be coercive.

“The Medicaid issue doesn’t have to do with the Commerce Clause. This has to do with the spending clause of the Constitution, so it tests what the federal government can do with its power to tax and spend. The essential question is whether state sovereignty and the state regulatory autonomy that’s so essential to the federal structure of our constitution is really just a sham. And this is an important issue.”

Mario Loyola, director of the Center for Tenth Amendment Studies at the Texas Public Policy Foundation, on the Health Care News podcast. http://www.healthpolicy-news.org/audio.html

Industry Expects to Pay Fines

Companies with many low-wage employees could start dropping coverage when the law goes into effect in 2014, says Edmund Haislmaier, a senior fellow for health care policy studies at the Heritage Foundation.

“We’re talking about an economic sector that employs many low-wage workers. These are less-skilled orderlies and basic aides who average about $9 to $11 an hour. The cost of providing them a benefits package is expensive, so that’s why so many in the industry already have no benefits or a limited benefits package,” explains Haislmaier.

According to Haislmaier, many nursing home employees and home health care workers do not have health insurance. Wages are typically low, and given the high expense of offering health care coverage for nursing home staff—even a bare-bones coverage plan—workers may not be able to afford their portion of the funding. The penalty for a midsize nursing home which does not provide insurance could easily exceed $200,000 a year.

“You can do the math and see that if their employers provide health coverage, there will be a 30 percent to 50 percent increase in labor cost. Now if they choose not to provide health coverage, they will pay a fine which increases their labor costs by only 10 percent,” he says.

Haislmaier notes a recent McKinsey Quarterly report found 33 percent of companies would drop their coverage for their employees.

“Restaurants, nursing homes, and other low-paying positions—these are going to be the first ones who drop coverage starting in 2014,” says Haislmaier.

Segmented Labor Market

Since the waiver is good only for one year, the companies will probably drop their employee coverage and ship them into the state health insurance exchange if they fail to get an extension. Thus taxpayers will be forced to pick up the worker’s cost of coverage, subsidizing plans that may cost $15,000 or more, notes Devon Herrick, a senior fellow with the National Center for Policy Analysis.

“Of course, the plans could be substantially higher in high-cost regions,” says Herrick. “I think it’s going to cost taxpayers a lot of money and segment the labor market into high-wage and low-wage funds.”

Herrick says some moderate-income people could get an annual federal government subsidy for as much as $30,000 toward health care insurance. For an older employee living in a high-cost area and earning nearly 400 percent of the federal poverty level (up to $90,000), the taxpayer subsidy could be as much as $20,000 a year.

“Instead of hiring maids and bellhops and professional staff, firms needing menial labor will hire them from companies that specialize in low-wage workers who [will] be paid higher cash wages and shown how to apply for subsidized health care,” Herrick said. “Firms or nursing homes that don’t do this will be at a competitive disadvantage with the ones that do.”

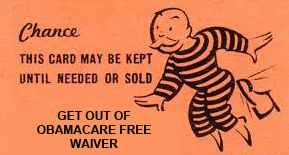

Waivers a Must

Health care is going to be a colossal burden on all the companies at this level, many of which need waivers to keep their doors open, says Dr. Roger Stark, a physician and health care policy analyst at the Washington Policy Center.

“There are already over 1,400 companies that have received waivers for the first year of ObamaCare,” says Stark.

“They’re already marginalized industries with low profit margins of 4 percent to 5 percent, so adding on the cost of health care for each employee is just not an option. The waivers are only good for one year. What are they going to do in the following year? I suspect that they will have to have a waiver or they will go out of business,” he says.

Republished with permission from The Heartland Institute