For mothers and fathers, watching their children reach adulthood and leave home to take their places in the world has always been a great source of satisfaction and pride.

For mothers and fathers, watching their children reach adulthood and leave home to take their places in the world has always been a great source of satisfaction and pride.

However, today’s sluggish economy and rampant unemployment has given birth to a troubling trend. Many young adults are moving back home in order to save money.

The empty nest many parents looked forward to is unexpectedly full again.

These “Boomerangers” as they’ve been dubbed, and their parents are caught in an unusual predicament because the move back home can have insurance implications for the entire family.

“Parents should make sure they know what obligations that young adult has,” says Jack Dewald, Immediate Past Chairman of the Life and Health Insurance Foundation for Education (LIFE).“The parents might not be legally responsible for his debt, but they might feel emotionally obligated.”

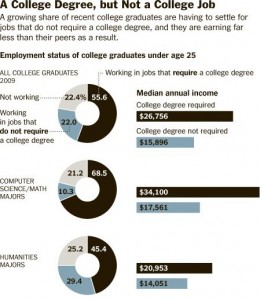

In addition to this, the job outlook for recent college graduates remains bleak. Northeastern University provided a chart highlighting the current job status of college graduates.

A child who moves back home can be included in his or her parents’ homeowner’s insurance policy.

A boomeranger might require additional coverage if they have to rent a storage locker for their belongings or expensive possessions.

Auto insurance is another important issue. Does a returning child have his or her own car that needs to be added to her parents’ policy? Or, will she need to be added as another driver to an existing policy? On the plus side, parents can keep any member of the family on their auto insurance policy as long as that person lives in the same house. On the down side, insurance rates could increase so parents may have to hunt for discounts.

Cautions Dewald, “Disability insurance needs to be reviewed. What happens if that child gets injured on the job? Does his parents’ insurance provide adequate disability insurance if he or she is injured? A disability that lasts longer than 90 days is more likely to occur at a young age than death.”

In many states, a parent’s health insurance policy can cover a child’s through his or her late 20’s. Check with state insurance departments to find out how state laws can affect coverage.

If a boomeranger doesn’t qualify for his parents’ policy, there are other options such as university alumni associations. Also, many states have insurance pools that guarantee coverage for people rejected by private insurers.