Appraising value

Of course, insuring anything brings up the question of what it’s worth. Weyhrich says it’s important to find a qualified appraiser, one that is typically certified through an appraisal organization and operates under Universal Standards of Professional Appraisal Practice. An appraisal doesn’t just give the owner an idea of what a piece of artwork or an old baseball card collection is worth, it can also serve as a documentation of ownership.

Alan Bamberger’s site is full of information on appraising and collecting art click here.

Spencer’s Art Law Journal

Published three times per year, edited by Ronald D. Spencer

click here.

A place to buy, sell and research fine art online

click here.

International Society of Appraisers

click here.

American Society of Appraisers

click here.

Appraisers Association of America

click here.

“If you have a piece that you may not know a lot about and if it’s significant in value then it’s worth going to an appraiser and having it appraised,” Weyhrich says. “What we tell folks is there are lots of different appraisers out there and most of them specialize in their respective fields, although you get some that are kind of generic. They may run an antique store or they may work for a real estate firm, but to find an appraiser who is familiar with your fine art item or your collection, is very important.”

Bamberger says he belongs to an appraiser organization and has served on its ethics board, but he considers his years of experience in the art world to be more important than taking the time to get a certification.

“There’s a difference between taking a 15-hour course on how to appraise art and getting certified and appraising art for 30 years and being not certified,” Bamberger says. “Certification doesn’t necessarily mean anything. It’s the experience of the appraiser that’s number one.”

For those buying more affordable or more recent artwork worth a few thousand dollars or so, Weyhrich says a sales document from the gallery with a description of the artwork or a certificate of authenticity could be sufficient for insuring an item. Appraisals or valuation statements from established auction houses are typically accepted as well. The higher the insurable value, the more documentation an insurance company would require.

The question of valuing a piece of art also brings up the issue of making sure something is authentic.

Hedge fund manager Pierre Lagrange may have found this out the hard way when he bought a painting in 2007 for $17 million that was said to be by Jackson Pollack. When Lagrange tried to sell it years later, auction houses Sotheby’s and Christie’s refused to handle the painting and questioned its authenticity.

A forensics test later concluded the artwork contained paints that were not available until after Pollack died. The gallery that sold the painting, Knoedler & Company, closed its doors the day after it was notified of this. Lagrange is suing the company and the FBI is investigating.

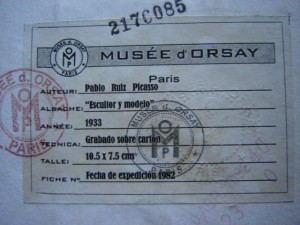

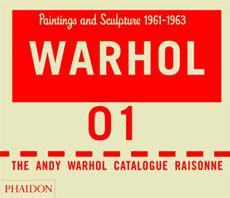

Part of the issue with Lagrange’s painting, the reason the auction houses wouldn’t touch it, was that it didn’t have a paper trail of documentation, known as a provenance, to indicate who had owned it and any galleries where it had been displayed. It also wasn’t included a published list of Pollack’s works known as a catalog raisonné.

Ronald D. Spencer, a lawyer specializing in art law, head of the art law practice at Carter Ledyard & Milburn LLP, and editor of the book “The Expert versus the Object: Judging Fakes and False Attributions in the Visual Arts,” says the use of forensics in the art world is rare. People are more likely to rely on provenance, and the catalog raisonné—of which there is usually just one accepted catalog for an established artist.

“They’re not going to sell you an expensive painting without giving you a list of provenance, a trail of ownership and exhibition history, that’s important,” Spencer says. “If it’s been exhibited in a major museum and had all kinds of experts look at it there, that’s important to know.”

A research project

Even with that information, Spencer says it’s important for a prospective buyer to question the dealer for details and to verify the information on their own. If an artwork was displayed in a museum there should be a catalog to prove it, along with supporting opinions from established authorities on that particular artist.

“You also want to know whether in fact those are really experts. Sometimes you get some guy’s opinion who’s not an expert. If somebody’s not an expert on Picasso you don’t much care if he thinks your painting is by Picasso,” Spencer says. “The dealer you’re buying from knows more about Picasso than your next-door neighbor but that doesn’t make him an expert on Picasso.”

He also recommends using a catalog raisonné that is used by established dealers, such as Sotheby’s or Christie’s, and that any artwork that’s not included in a raisonné should be investigated by the buyer. It could be the author of the catalog wasn’t aware of a particular artwork or didn’t think it was legitimate. If an updated raisonné is in the works, it would be important to find out whether a particular artwork will be included.

“It’s a research project. Buying high-quality art, expensive art, is a game of hardball, it’s not tiddlywinks and there’s a lot of risk involved. You can reduce that risk by doing the kind of due diligence that we’re talking about, but you can’t do away with the risk,” Spencer says.

Bamberger says other documentation could include gallery receipts, statements from the artist or perhaps a picture of the artist with the artwork itself.

“Things that have to do with a history of the art and may have a bearing on its significance at some point in the future. It might be a picture of the art in a museum catalog, or a gallery catalog or on the gallery and announcement for a show opening.,” Bamberger says. “It could be anything, as long as it directly relates to that picture and its significance one way or another.”

Experts recommend getting art reappraised every few years, as values can change dramatically if a particular artist suddenly becomes popular. Weyhrich says the values of gemstones, diamonds and precious metals have skyrocketed in recent years.

“I’ve seen some unbelievable appreciation in the value of some jewelry items so we normally recommend every two to three years for jewelry,” Weyhrich says. “With fine art you may not need to go that often, again it depends on the artist but you know every three to five years it’s not a bad idea to have those kinds of things reappraised.”

It’s important to keep in mind, however, that an appraisal and a certificate of authenticity are not the same thing.

“What they typically will do in a formal appraisal is assume that the piece is authentic and so state it in their appraisal,” Spencer says. “Appraisers are not art historians, and even if they are art historians they’re not experts on that particular artist. He can tell you, based upon these sales of 10 Picassos’ over the last year that your piece is worth $1 million but he can’t tell you whether Picasso actually painted that picture.”

For those buying more affordable or more recent artwork worth a few thousand dollars or so, Weyhrich says a sales document from the gallery with a description of the artwork or a certificate of authenticity could be sufficient for insuring an item.

Appraisals or valuation statements from established auction houses are typically accepted as well. Naturally, the higher the insurable value the more documentation an insurance company would require.

This article was originally published by Consumer Insurance Guide