Many employers provide their employees with group long term disability insurance (LTD). While this is a nice benefit for employees, you should be aware of the pitfalls inherent in group LTD plans and how to shore those up. There are major differences between group and individual disability insurance plans, and a combination of the two usually provides the most comprehensive and cost effective coverage. Since your income is the most valuable tool you have for…

Read MoreBusiness

All articles about business insurance or related to business insurance from Consumer Insurance Guide.

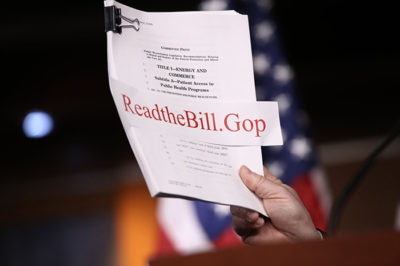

Shut It Down! The Healthcare Battle That Will Shut Down the US Government

Congress must pass a bill this week to keep most of the government running beyond Friday when a government spending bill runs out. It won’t be easy. The debate over a new spending bill focuses on an esoteric issue affecting the Affordable Care Act. The question is whether Congress will pass — and President Donald Trump will sign — a bill that also funds subsidies for lower-income people who purchase health insurance under the law….

Read MoreCyber Liability Poses Risks Not Covered By Ordinary Insurance

It’s all but impossible to do business today without computers and the Internet. Even if a computer is used for nothing more than accounting and keeping track of orders, a data loss or equipment failure could mean economic hardship for any company. Throw in the use of email, a website or social media and a company’s risk exposure could be greater than that posed by the more physical threats of fire or other disasters—especially where…

Read MoreDrone Insurance? It’s Coming Your Way From Above

New technologies are impacting many different industries – and have been as long as commerce has been taking place. Whether it be when JC Penny and Sears and Roebuck were selling products to gold miners in the 1850’s or when Henry Ford was selling the Model T in the first half of the 20th century, companies that adapt to technological change are the companies that succeed in the long term. At this time technological advances…

Read MoreFollow the Money – Insurtech Is Pulling Big Funding From Venture Capitalists

Insurers predate the adoption of electricity. But it’s innovation which sets precedents that ultimately result in tidal shifts in the way business is conducted. While the US insurance industry alone produces more than $1 trillion of revenue a year, there’s still plenty of room for growth – and room to take advantage of opportunities. One outfit at the bleeding edge of how insurtech startups come into being, Plug and Play, say they plan to fund…

Read MoreHow Drunk Tweets and Big Data Will Affect You and Your Insurance Premiums

Like it or not, Big Data is fast becoming critical to competing in the field of insurance from underwriting to rating in the property and casualty insurance markets. As a result, the National Association of Insurance Commissioners (NAIC) are taking up the gauntlet and their Innovation and Technology Task Force is focusing on offering consumer protections related to how that influx of data is utilized. The deputy commissioner and chief actuary from the Alabama Department…

Read MoreAirsurety Has You And Your Family Covered On Your Trips Around the World

If you’ve ever stood around in an airport thinking about buying travel insurance, we’re pretty sure you found the process confusing – so many options and different types of coverage can leave your eyes rolling back in your head. Now a new insurtech venture, Airsurety, Inc., has simplified the process of buying your travel insurance policy with what they call Accidental Death Benefit on an Airplane. It’s straightforward stuff and simple to understand. Airsurety offers…

Read MoreInsurtech Company Fabric Aimed at Niche Marketing Life Insurance to Busy Young Parents

They call them ‘insurtechs,’ and the focus is on using the latest in data and AI technology to sharpen the competitive edge for life insurance companies. One of the hottest players in the game, Fabric, has targeted new and expecting parents. “Life insurance isn’t something you think about – or buy every day – and the existing system is built to take advantage of your confusion,” says Adam Erlebacher, a co-founder of Fabric. “You should…

Read MoreYour Lifestyle Is Killing You – And Jacking Up Your Insurance Rates

You know it for a fact. Life is about choices, and regardless of how much pleasure those choices can provide you, some of them will leave you paying more for life insurance. But have no fear, some of the most likely causes for sky-high insurance rates can be the easiest to fix. Stop Supersizing Everything You Do! Okay, so you porked up a bit and there’s some excess weight hanging over your belt. When it…

Read MoreTexas Hailstorm Insurance War

Homeowners in Texas deal with severe weather in the form of hailstorms, tornadoes and wildfires. Over the course of the last few years, those homeowners are also dealing with what state insurance experts call a “systematic effort by certain lawyers and their associates to abuse both the insurance claims system and the court system” for their personal gain. The experts are calling on the Texas Legislature to put a stop to some well-documented techniques which might result…

Read More